You applied for and got approved for the American Express Cobalt card. Whats next so you can maximize what you can get out of this card? Read on to see “Whats in it for me?”

Firstly, if you are signing up for several cards at the same time, please ensure you have a plan or expenses coming up to put on the card(s) so you can meet the Minimum Spend Requirement (MSR) so you do not miss out on the “Welcome Bonus” – in this case, its monthly minimum spend for the first 12 months.

Now, lets put the card through the paces.

- Plan your purchases so that you meet the MSR for the first 12 months.

In your first year as a new Cobalt Cardmember, you can earn 2,500 Membership Rewards points for each monthly billing period in which you spend $500 in purchases on your Card. This could add up to 30,000 points in a year. - Use this as your main card for dining, food delivery and groceries.

You can earn Membership Rewards points for eligible consumer purchases at American Express retail merchants as follows:

Earn 5 points for every $1 at

(i) restaurant, quick service restaurant, coffee shop and drinking establishments in Canada,

(ii) stand-alone grocery stores in Canada,

(iii) delivery of food and groceries in Canada as a primary business, up to a combined maximum of $30,000 in net purchases posted to your account annually on these categories.

Note: Once the maximum is reached, you will no longer earn at 5 points for every $1 regardless of credits, returns and adjustments but you will earn only 1 point for every $1 thereafter. Calculation resets to zero each year on the cardmembership anniversary date. - Earn 3 points for every $1 on eligible streaming subscriptions at select providers in Canada. The current list of providers is available at americanexpress.ca/streaming. Purchases with merchants that are not on the list or that are on the list but bundled with another product or service or billed by a third party such as a digital platform or a cable, telecommunications or internet provider, or a car manufacturer, are not eligible.

- Earn 2 points for every $1 at or for

(i) stand-alone automobile gasoline stations in Canada,

(ii) travel services or travel bookings including air, water, rail and road transport, lodging and tour operator sales,

(iii) local commuter transportation in Canada including subway, streetcar, taxi, limousine and ride sharing services. - Basic Cardmembers can earn one additional bonus Membership Rewards point for every dollar charged to your American Express Cobalt Card for eligible hotel and car rental bookings (less credits and adjustments) made through the American Express Travel website where American Express Travel (not the hotel or car rental company) is the merchant.

Now let us look at all the benefits that come along with this card:

A. Earning points on all the spend you put on the card.

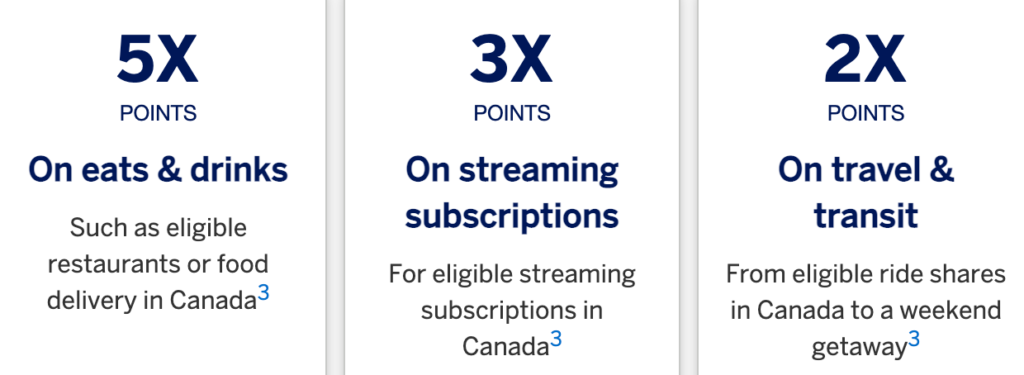

As noted above, here is the multiplier again per $1:

5x on Eats and drinks

3x on streaming subscriptions

2x on travel & transit

1x on everything else

B. Referral Bonus

You can refer a friend and earn a referral bonus, currently at 15,000 MR Points (compared to the normal 10,000) for each approved referral, up to a maximum annual referral bonus of 75,000 Membership Rewards points for approved referrals.

C. Perks

You will receive regular Perks, including bonus rewards and access to great events.

e.g.:

Staples-Spend at least $150 and earn a $30 credit

Lululemon-Spend at least $125 and earn a $25 credit

Eataly – Hands-On Gnocchi Making Class

D. Better Stays with the Hotel Collection

-Up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

-A one-category room upgrade at check-in, when available

E. Mobile Device Insurance

When you fully charge or finance the purchase price of an eligible mobile device to your American Express Cobalt Card, you can be covered for up to $1,000 per insured person, in the event of theft, loss or accidental damage, anywhere in the world.

F. Travel Coverage

Several coverages are available for your road trips and flights.

See here for more details on some exclusions due to Covid.

G. Out of Province/Country Emergency Medical Insurance

Coverage of up to a maximum of $5,000,000 for eligible emergency medical expenses incurred by an insured person under age 65 while travelling outside your Canadian province or territory of residence for the first 15 consecutive days of a covered trip.

H. Flight Delay Insurance

You can receive up to $500 in coverage (aggregate maximum with Baggage Delay Insurance) for necessary and reasonable accommodations, restaurant expenses and sundry items purchased within 48 hours when delayed or denied boarding for 4 hours or more and no alternate transportation is made available when you fully charge your airline ticket to your American Express Cobalt Card.

I. Baggage Delay Insurance

You can receive up to $500 in coverage (aggregate maximum with Flight Delay Insurance), for reasonable and necessary emergency purchases for essential clothing and sundry items purchased within four days of arrival at your destination when your checked-in baggage on your outbound trip is delayed for 6 or more hours when you fully charge your airline ticket to your American Express Cobalt Card.

J. Hotel Burglary Insurance

You can receive up to $500 in coverage against the loss of most personal items (excluding cash) if your accommodation is burglarized when you fully charge your accommodations to your American Express Cobalt Card.

K. Lost or Stolen Baggage Insurance

You can be covered for loss or damage to your checked-in or carry-on baggage and personal effects while in transit for up to a maximum of $500 per trip for all insured person(s) combined when you fully charge your airline tickets to your American Express Cobalt Card.

L. $250,000 Travel Accident Insurance

You can be covered up to $250,000 of Accidental Death and Dismemberment Insurance when you fully charge your common carrier (plane, train, ship or bus) tickets to your American Express Cobalt Card.

M. Car Rental Theft and Damage Insurance

You can be covered for theft, loss and damage of your rental car with an MSRP of up to $85,000 for rentals of 48 days or less when you fully charge your rental to your American Express Cobalt Card.

What can you do with MR Points?

Amazon Shop with Points

You can use for MR Points for shopping at Amason.ca.

Notes:

Certain items at Amazon.ca are not eligible for purchase using MR Points.

MR Points may not be used when making purchases with 1-Click.

If you do not have enough MR Points to pay for your eligible purchase, you can pay for the remainder with the Amex credit or charge card linked to your MR Points Account, or an Amazon.ca Gift Certificate.

Payment at American Express Travel Services.

Membership Rewards points are accepted as payment for a wide range of travel options through American Express Travel Services. Membership Rewards points can be used to pay for new travel purchases, including taxes and surcharges. Membership Rewards points are not refundable.

Use Points for Purchases

You can redeem Membership Rewards points for a statement credit towards an Eligible Purchase charged to an Eligible Card. You must redeem a minimum of 1,000 points per redemption.

The Fixed Points Travel Program

This applies to return airfares offered through American Express Travel Services Canada or americanexpress.ca/travel. Under the Fixed Points Travel Program, a fixed number of points covers the base ticket price of eligible flights up to the applicable maximum base ticket price. The flight grid includes the fixed number of points with the corresponding applicable maximum base ticket price required per catego

Transfer MR Points

You can also transfer Membership Rewards points 1:1 to several frequent flyer and other loyalty programs e.g. Aeroplan, BA Avios, Etihad, Hilton, Bonvoy etc.

Redeem MR Points for Gift cards

You can redeem MR Points for gift cards and merchandise through membershiprewards.ca

Here are some Points to remember:

1. The monthly fee is not a part of the MSR.

2.Always spend a bit over the MSR, in case you do a return and risk going below the MSR and lose getting the Bonus.

3. Make a note of the billing cycle. Purchases made during a billing period but posted after the end of that billing period will not count towards eligible spend for that month and count towards eligible spend for the next billing period.

Another important point to note is that the American Express has once per lifetime on each card for the Welcome and Bonus offers but having said that Your mileage may vary (YMMV). As per the fine print on this card – This offer is only available to new American Express Cobalt Cardmembers. For current or former American Express Cobalt Cardmembers, you may get approved, but will not be eligible for the Membership Rewards points offers available in the first 12 months of Card Membership.

Snapshot:

-Monthly Fee $12.99

-Supplementary card at $0 for a maximum of 9 supplementary cards per account.

-Monthly Bonus of 5,000 MR Points after spending $500 in net purchases on your Card each month for the first 12 months of Cardmembership.

-5x MR Points on Eats and drinks

-3x MR Points on streaming subscriptions

-2x MR Points on travel & transit

-1x MR Points on everything else

-Earn points for referring family and friends to this card using your referral link. If you dont have a referral link to apply from, you can support my blog and website by using my referral link.

You should also check for any offers through GreatCanadianRebates for any Cash Back Rebates.

To Summarise:

If you maximise all the offers, you can earn a total of 30,000 MR Points and additional 15,000 MR Points (limited time increase from 10,000 to 15,000) for each referral that you do.

This is a card that I would keep year after year purely for the 5x multiplier on dining, food delivery and groceries.

Written by Dominic Fernandes aka CanadaPointsGuy.

Image courtesy of americanexpress.com/ca.

In the Snapshot section of this article, I believe the $512.99 monthly fee is a typo. Should be $12.99.

Thanks for pointing that out – corrected now.