Air Canada and Uplift has collaborated to offer flexible, pay-over-time booking options in addition to the current options to pay using cash, vouchers and Aeroplan points.

This is similar to what Porter, rolled out in July of this year.

As per the media release dated December 08, 2020, “Air Canada and Uplift today announced a new collaboration, giving the airline’s customers access to Uplift’s flexible, financing options. Travellers can now book flights from Canada and the U.S. to destinations throughout Air Canada’s global network and pay for those trips over time with Uplift.”

The media release goes on to say:

Uplift provides users the freedom to finance their trip and pay for it over time. Customers can easily compare the costs of paying monthly with those of paying upfront, choosing the option that works best for them. There are no prepayment penalties and travellers clearly see the interest rate and total cost of the trip at the time of booking.

Customers will be given the option to pay Air Canada in full or pay monthly through Uplift at time of booking. When selecting monthly payments customers can quickly apply online to receive an estimate of monthly payments and advance purchase amounts. Travellers can use Uplift to secure best available pricing, book a last-minute trip, add benefits such as preferred seats or upgrade flights to Premium Economy and Business Class, while easily managing the costs with fixed, affordable monthly payments.

I took this process for a test run to check out the mechanics.

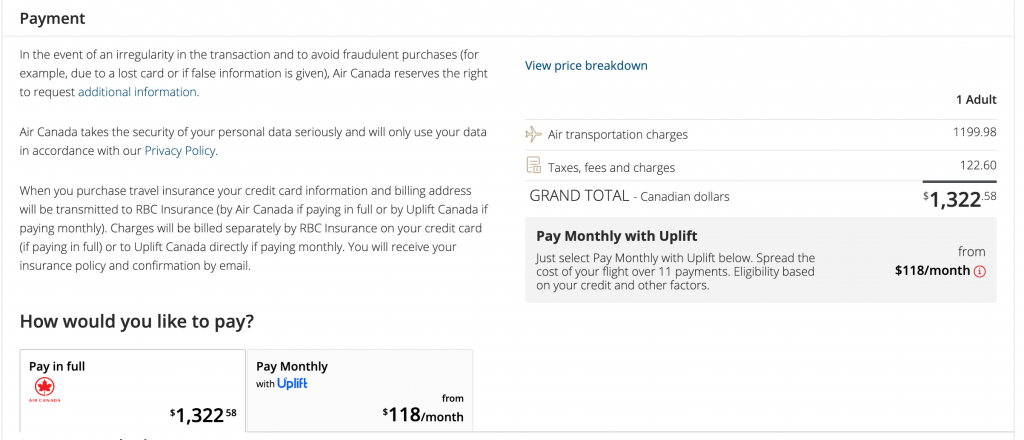

The initial part of booking process is the same as before, and you are presented the options at the payment screen as below where you have the option to “Pay in full” or “Pay Monthly” by financing through Uplift:

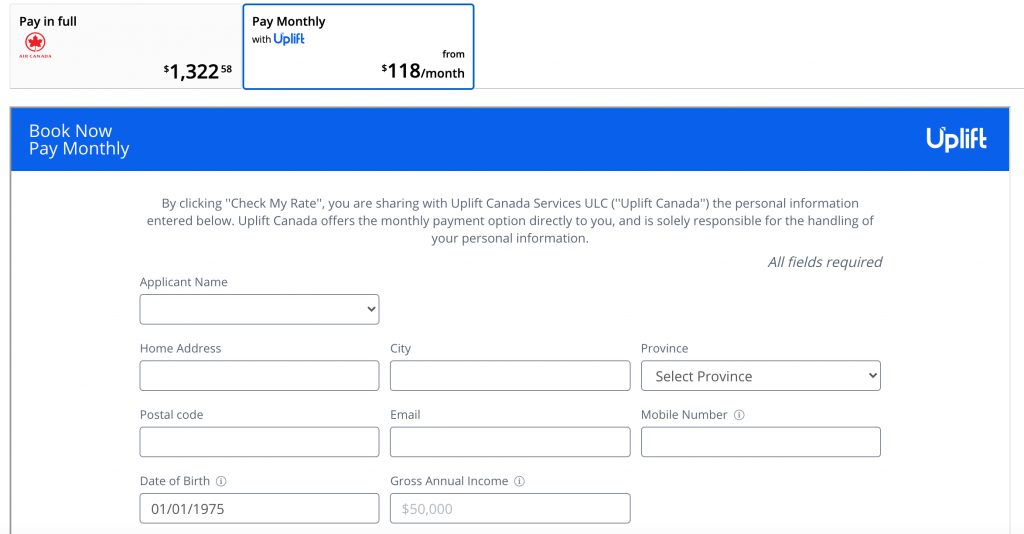

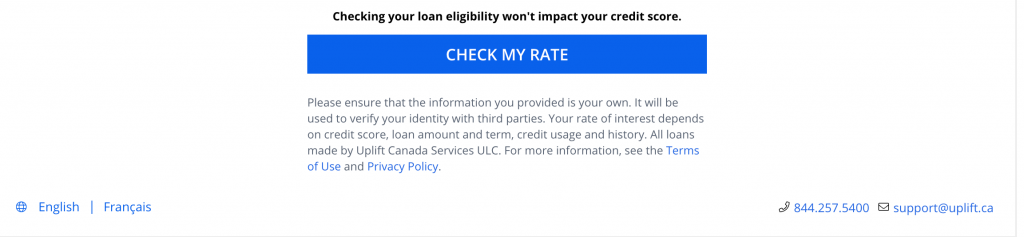

Next, if you elect to “Pay Monthly”, you need to enter your personal details for the application to be processed by Uplift.

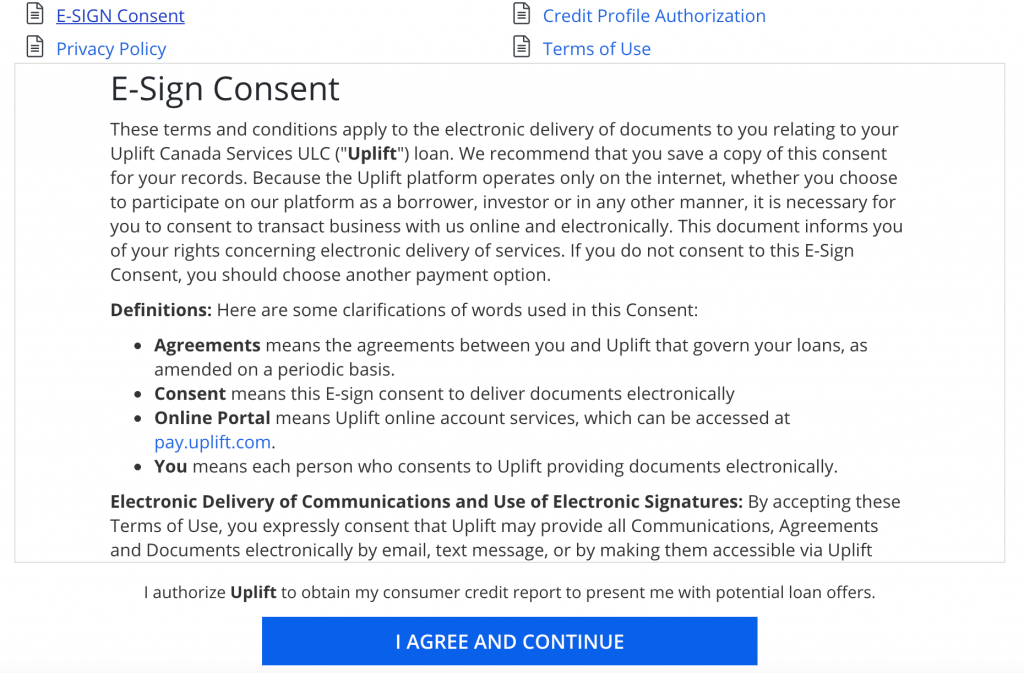

You then need to agree to all the legal stuff…

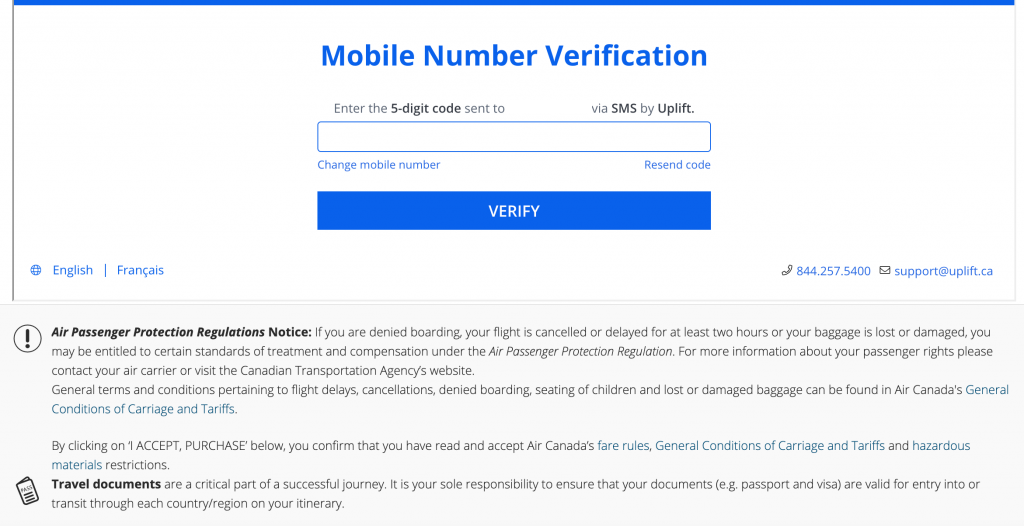

Finally, you will receive a 5-digit code to be entered for verification.

So what are the pros and cons of this feature?

Well, for the pros, it offers you the opportunity to spread your payments in affordable monthly payments.

As for the cons, remember that since you are not using a credit card or debit card, and if the flights get cancelled in the current environment, you would be forced to accept a voucher or Aeroplan points.

You would not have recourse to do an internal or statutory chargeback.

Note that if a flight is cancelled, you need to deal with Air Canada for the refund. Then, if Uplift receives a refund, they will apply the credit amount to reduce your loan balance. If the refunded amount is more than your outstanding loan balance, Uplift will issue a refund to your payment method on file.

However, if AC issues travel refund credits (e.g. airfare credits, vouchers, Aeroplan Points) directly to you or charges a cancellation fee, you will still be liable for your outstanding loan balance with Uplift.

Written by Dominic Fernandes aka CanadaPointsGuy.