Porter appears to have partnered with Uplift to offer travellers the option to pay monthly and stagger payments instead of having to pay as a lumpsum. This allows you to budget your finances and pay in smaller amounts monthly.

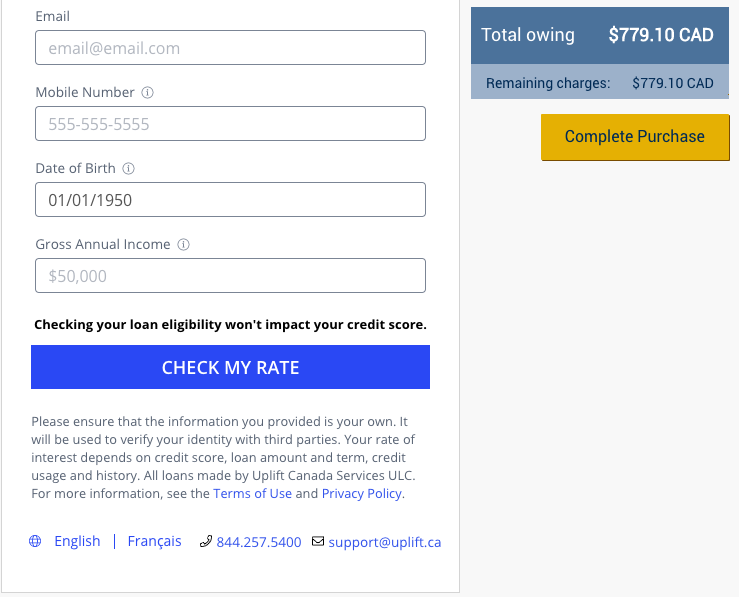

All you need to do is complete a short application to check eligibility. It appears the interest rate is determined by your credit score and the trip you are booking.

So, how does it work?

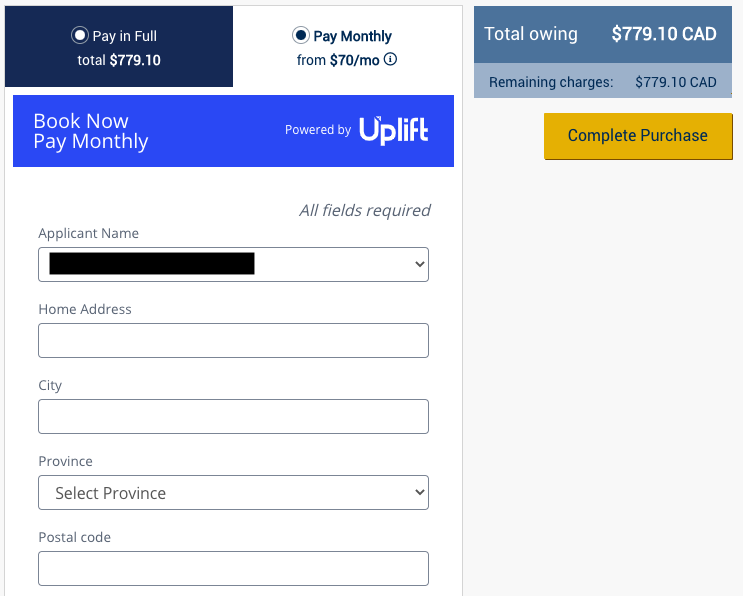

After you have booked your travel, you are presented with the following option to “Pay Monthly”. You need also need to enter some personal information to be approved. It does go on to say “Checking your loan eligibility won’t impact your credit score.”

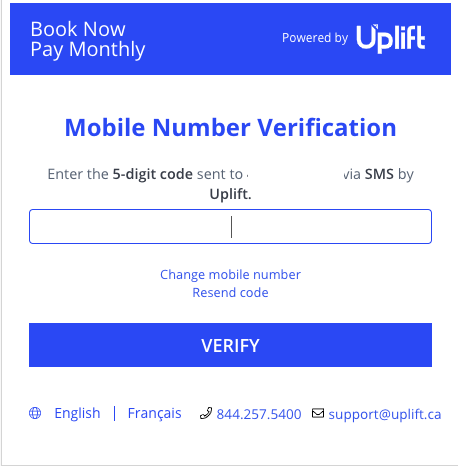

You will then receive a text message to validate that you are indeed looking at getting approved.

I personally would not use this feature due to one main factor:

If the flights get cancelled in the current environment and I am forced to accept a voucher, then my options are rather limited.

As, if I need to initiate a chargeback, I cannot do this with this method of payment.

Besides, why pay when you can use VIPorter points?

So, is this something you would be taking advantage of? Let us know in the comments below. Note, however that as it stands today, Porter has suspended all flights and will resume operations on August 31, 2020.

Written by Dominic Fernandes aka CanadaPointsGuy.

Image photo courtesy of flyporter.com

[…] Air Canada and Uplift has collaborated to offer flexible, pay-over-time booking options in addition to the current options to pay using cash, vouchers and Aeroplan points.This is similar to what Porter, rolled out in July of this year. […]